Surrender Life Insurance Policy Definition

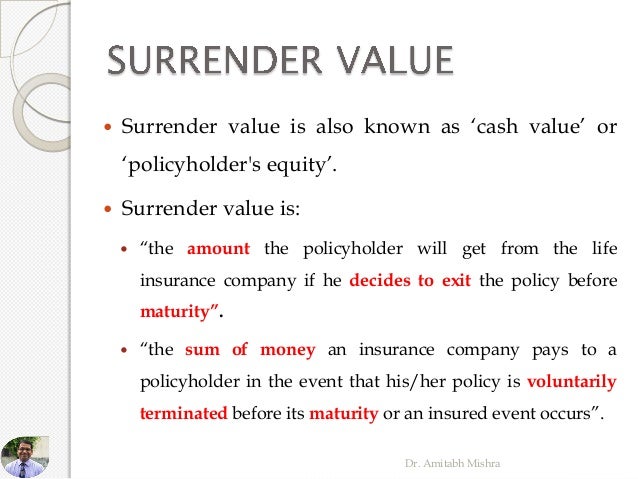

Surrender value if the sum of money that is payable by the insurance company when you terminate your insurance policy before its maturity. For this reason we highly recommend that our guests speak in depth with their trusted financial advisor before terminating a whole life contract.

Cash Value And Cash Surrender Value Explained Life Insurance

If you sell cash in or cancel your investment early you will have to pay a surrender charge.

Surrender life insurance policy definition. The cash surrender value in a permanent life insurance policy is the cash value minus any applicable surrender charge. Say if you have a plan for 10 years and you want to end the plan and avail any benefit after the first 5 years itself it. Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features including the period of protection face amount.

The surrender value is the actual sum of money a policyholder will receive if they try to access the cash value of a policy. When you surrender your life insurance you are telling the insurance company that you dont want life insurance coverage. A surrender charge is a fee levied on a life insurance policyholder upon cancellation of their life insurance policy.

Surrender Value Surrender value also called cash surrender value is an amount of money that you as a life insurance policy holder receive if you decide to terminate surrender your life insurance policy eg. The cash in the life insurance policy never leaves the policy. The fee is used to cover the costs of keeping the insurance policy on the.

Surrender value is the cash value you will get when you cancel your policy before its due date of maturity. That means policy acquires surrender value on completion of the first three years. Purchasing a life insurance policy gives an individual or couple the ability to transfer the financial risk of loss of income or the burden of estate taxes to an insurance company in exchange for.

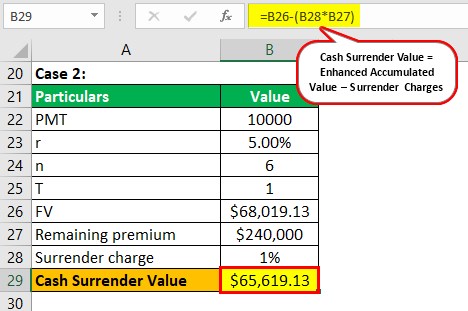

The surrender value is the amount of money one receives after surrendering the policy which may only be a small amount of the payments on has been making. Cash surrender value is the sum of money an insurance company pays to a policyholder or an annuity contract owner if their policy is voluntarily terminated before its maturity or an insured event. When you cancel a life insurance policy for.

Surrendering your life insurance policy means giving up the plan before the stipulated time and redeeming the benefits applicable as on that date. The surrender value of your policy depends on how much cash value you have and what if any surrender penalty exists when you want to cancel it. Other names include the surrender cash value or in the case of.

In exchange the policyholder receives a portion of the cash value of. A mid-term surrender would result in the policyholder getting a sum of what has been allocated towards savings and the earnings thereon. The surrender value is the actual sum of money a policyholder will receive if they try to access the cash value of a policy.

This is true even when generating a loan that goes beyond the cost basis of the policy. Whole life Insurance policy before it matures or before you die. From this will be deducted a surrender charge which varies from policy to policy.

Generally most of the traditional insurance plans can be surrendered for cash after completion of three policy years. These costs and the policys surrender value can fluctuate over the life of a policy. They are imposed for a pre-set number of years to allow the issuing company to recoup the cost of offering you the product.

Do all life insurance policies have a cash surrender value. Loan and Withdrawal Distribution. A had the right to change the beneficiary take out a policy loan or surrender the contract for its cash surrender value.

Surrender charges are fees imposed on investments annuities and life insurance policies. Because the money never leaves the policy and because the IRS does not view loans as income in most cases the life insurance policy loan is a non-taxable event. Contract A was the insured and the named beneficiary was a member of As family.

How Is Cash Surrender Value Calculated. The contract in As hands was not property described in 1221a1-8. After a certain time period the surrender costs will no longer be in effect.

Cash Surrender Value Of Life Insurance Meaning Examples

How To Do A Partial Surrender Of Your Life Insurance Policy

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Annuity Vs Life Insurance Similar Contracts Different Goals

Cash Value And Cash Surrender Value Explained Life Insurance

Cash Value And Cash Surrender Value Explained Life Insurance

Glossary Of Life Insurance Terms Smartasset Com

Cash Surrender Value Definition What Does Cash Surrender Value Mean Youtube

Surrender Value In Life Insurance By Dr Amitabh Mishra

What Is The Surrender Value Of Life Insurance Abc Of Money

Whole Life Insurance Definition Benefits Pros Cons

Cash Value Vs Surrender Value What S The Difference

What Is Surrender Value And Paid Up Value Of A Life Insurance Policy

What To Know About Cashing Out Life Insurance While Alive

Should You Keep Or Surrender A Universal Life Policy

Cash Surrender Value Of Life Insurance Meaning Examples

:max_bytes(150000):strip_icc()/life_insurance_87614098-5bfc37104cedfd0026c3e06a.jpg)

Post a Comment for "Surrender Life Insurance Policy Definition"