Supplemental Life Insurance And Add

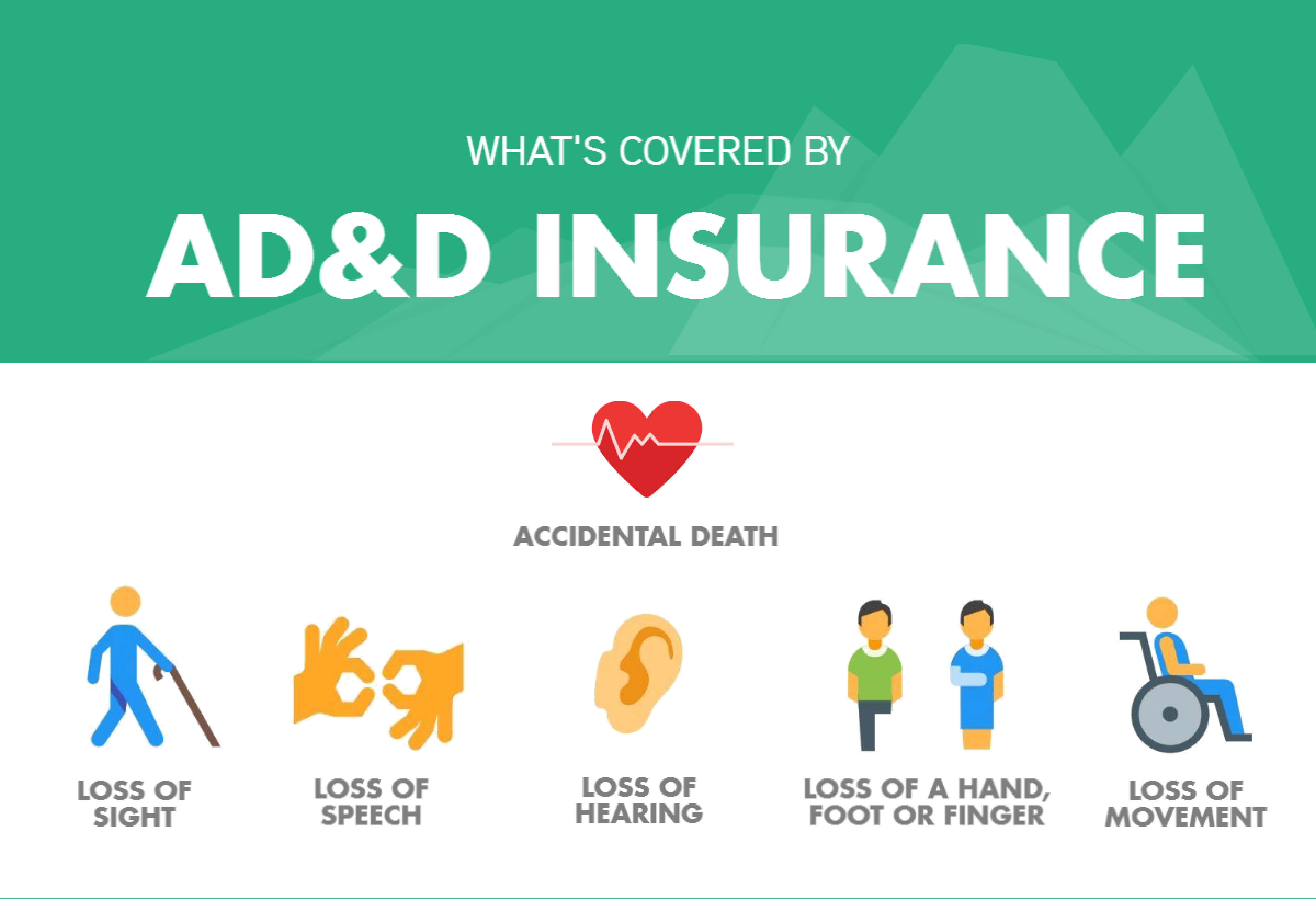

Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event you die or become dismembered in an accident. However these policies often have some exclusions.

Voluntary Life Insurance The Hartford

Many times banks will offer you a free ADD plan with your account.

Supplemental life insurance and add. Life Insurance pays your beneficiary please. Supplemental Life Insurance which you pay for is coverage in addition to the Basic Life Insurance that your employer provides to you. Supplemental spouse life insurance covers the life of your spouse.

Typically these policies have a very low benefits associated with them and could be anywhere between 5000 and 10000 - depending on what your employer offers. Supplemental insurance is a rider that you can add onto the base policy that allows you to purchase additional insurance as time goes on during certain stages of your life. Supplemental life insurance is as you might guess a form of additional life insurance.

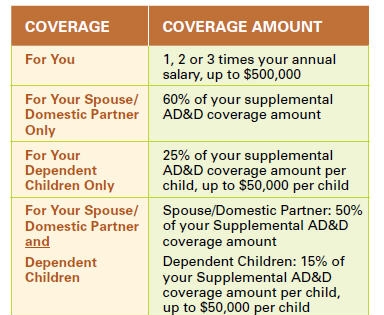

However coverage cannot exceed 100 of the employees Supplemental Life and ADD. Your employer provides at no cost to you Basic Life Insurance in an amount of 15000. If you elect Employee Supplemental Life and ADD Insurance you may purchase Spouse Supplemental Life and ADD Insurance in increments of 5000 5000 minimum to a maximum of 250000.

Here are the four main types of supplemental life insurance offered through employers. Supplement ADD Insurance would only pay for death or dismemberment due to accident. Supplemental Life Insurance would pay for death by any reason.

Supplemental employee life insurance adds coverage to your own policy. Supplemental life insurance is when a rider is purchased to increase the value of the policy without taking out a new life insurance policy altogether. It only covers accidents not natural death or injury from illness.

You may find that your workplace supplemental life insurance is a type of burial insurance policy. Supplemental life insurance offered by an employer is additional term life insurance that you can purchase that is above and beyond the employer-provided basic coverage. Supplemental Life Insurance In addition to providing basic life insurance employers may give employees the opportunity to separately purchase supplemental group term life insurance and even insurance on their spouses and dependents but entirely at the employees expense.

Supplemental ADD accidental death and dismemberment policies are very expensive plans when you weigh the benefit against the likelihood of paying a benefit. If you feel that your employers life insurance amount is not sufficient for your needs purchase the supplement Life policy. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations such as ADD or burial insurance.

What is Supplemental Life Insurance. As with basic coverage it usually can be bought in the form of a multiple of your annual salary. As a Stanford employee you are automatically enrolled in our basic life insurance program.

But it will give your family. In many cases this type of policy will also cover a. There is no cost to employees for basic life and coverage is 1x salary up to a max of 50000.

Supplemental insurance is not usually available on a term life policy because that type of coverage is already constrained within certain defined limits and conditions but is more often taken out to supplement a whole or variable life insurance. Far more deaths occur as the result of illness than accident. This option may.

We provide basic life insurance plus the opportunity to purchase supplemental life insurance. Its not meant to take the place of a good term life insurance policy. ADD insurance is not a replacement for life insurance.

And it is deducted from payroll. ADD insurance premiums are as low as 60 per year depending on the amount of coverage you buy and the benefits it provides. What is Supplemental Life and ADD Insurance.

Part of life insurance is planning for the future. You can purchase ADD insurance as a separate product or endorsement on your life insurance policy. However ADD insurance is not a substitute for life insurance.

A 30-year-old may not need a 500000 life insurance policy today but they lock in the lower price for the term of the policy.

Would You Want To Burden Your Family With Your Debts Let Life Insurance Pay For Burden Life Insurance Quotes Life Insurance Facts Life Insurance Policy

Great Images Health Insurance Terms Healthinsurance Strategies The Very Best Wellness Insurance Health Insurance Plans Employee Health Best Health Insurance

Medishare Review Everything Christian Families Need To Know Health Insurance Plans Affordable Health Insurance Plans Health Insurance

Accidental Death Dismemberment Ad D Texas Bar Private Insurance Exchange

Accidental Death Dismemberment Insurance Faq Body Copy

Why Life Insurance Because Your Family Is Worth It Life And Health Insurance Life Insurance Marketing Ideas Life Insurance Facts

Should I Buy Group And Supplemental Life Insurance Valuepenguin

Pin On Cover 360 Com Best Insurance Provider In India

Social Media Infographics Life Happens Life Insurance Cost Life Insurance Marketing Life Insurance

Life Insurance Plans American Fidelity

Medicare Supplement Plan Medicare Supplemental Insurance Medigap Medicare Supplement Medicare Supplement Plans Medicare

Ask Me About Life Insurance Button Zazzle Com Life Insurance Marketing Life Insurance Humor Life Insurance Facts

Accidental Death Dismemberment Ad D Insurance

What To Know About Ad D Insurance Forbes Advisor

Voluntary Life Insurance Quickquote

How To Add A Wife To Health Insurance Health Insurance Humor Health Insurance Supplemental Health Insurance

Post a Comment for "Supplemental Life Insurance And Add"