The Insurance Mandate Of The Aca Is Still In Effect

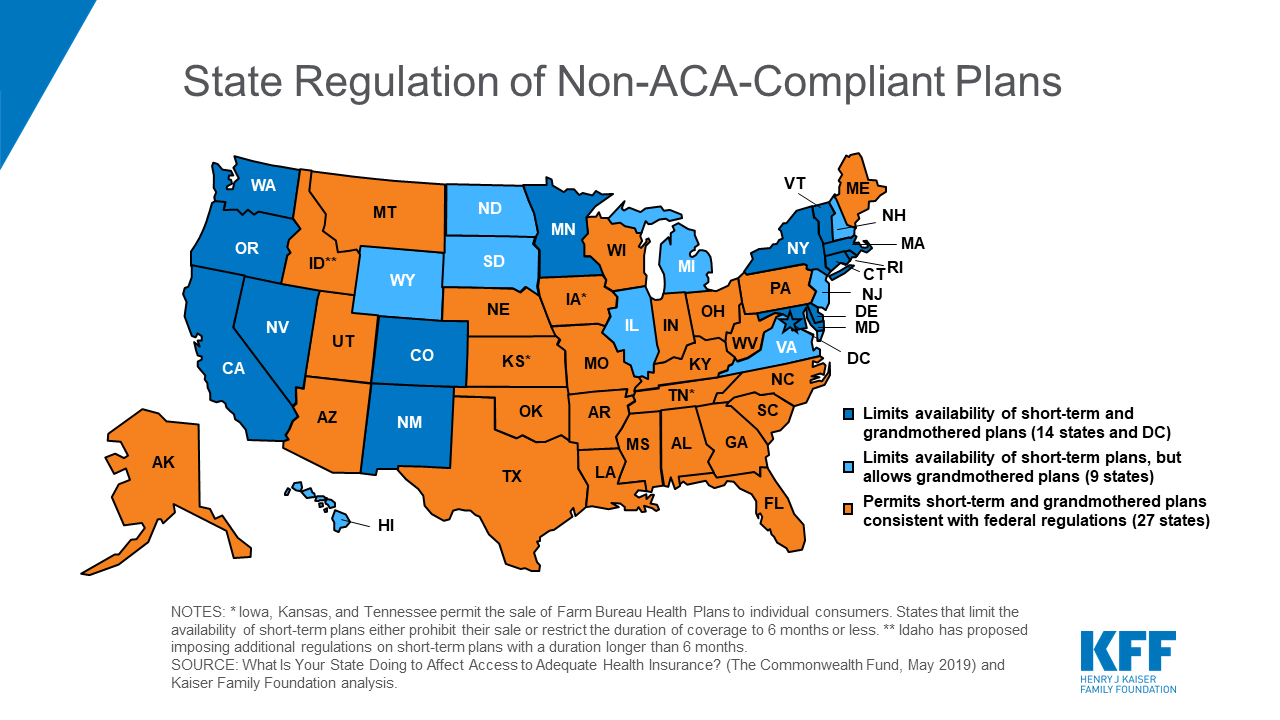

Since 2019 there is no penalty for not having ACA coverage so healthiest people with be enrolling in short-term plans that are cheaper and offer larger networks however these plans do not protect pre-existing conditions. But Congress did ultimately chop off a leg when the mandate penalties were eliminated as part of the 2017 tax bill and despite these predictions the Affordable Care Act still stands.

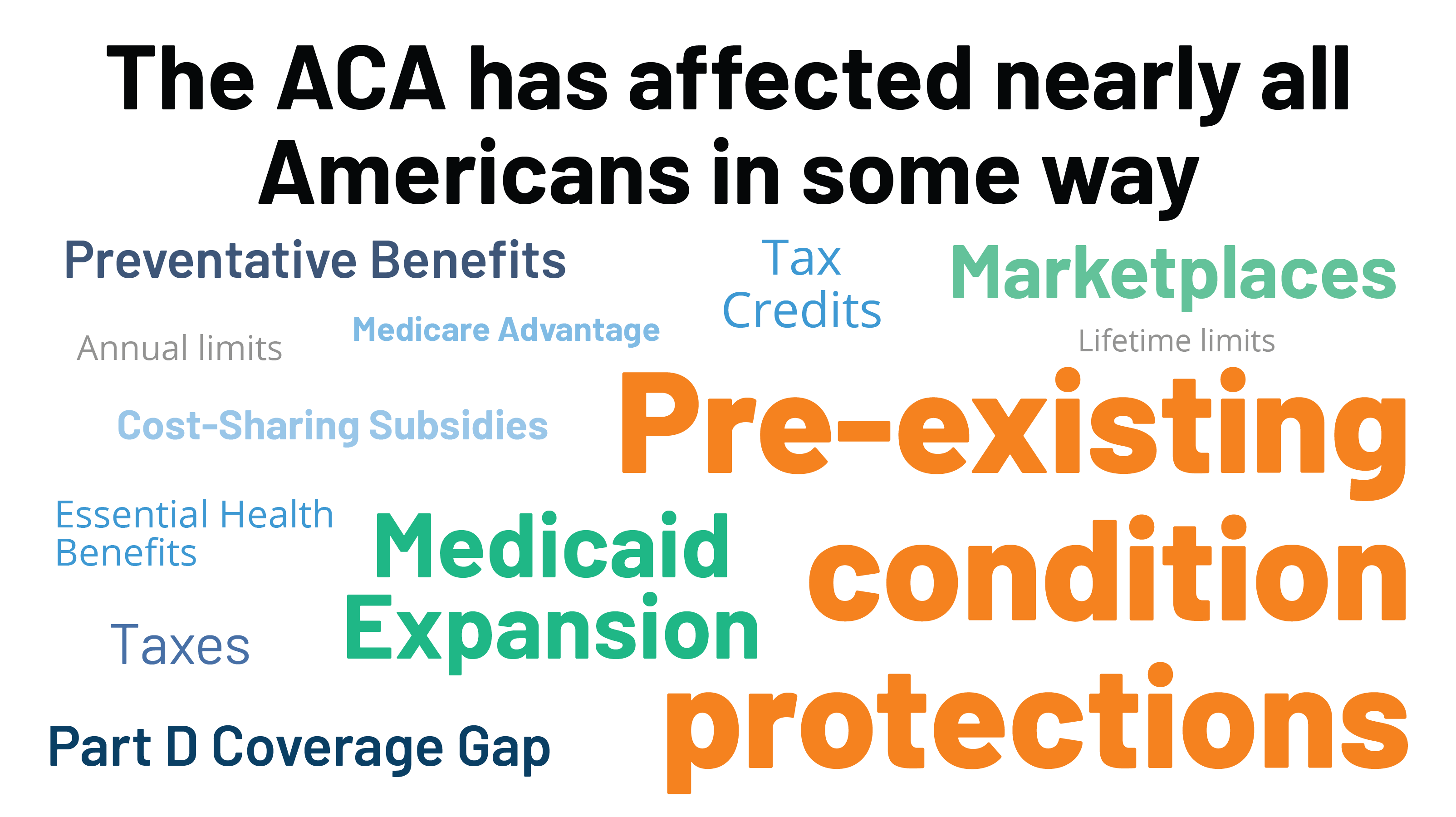

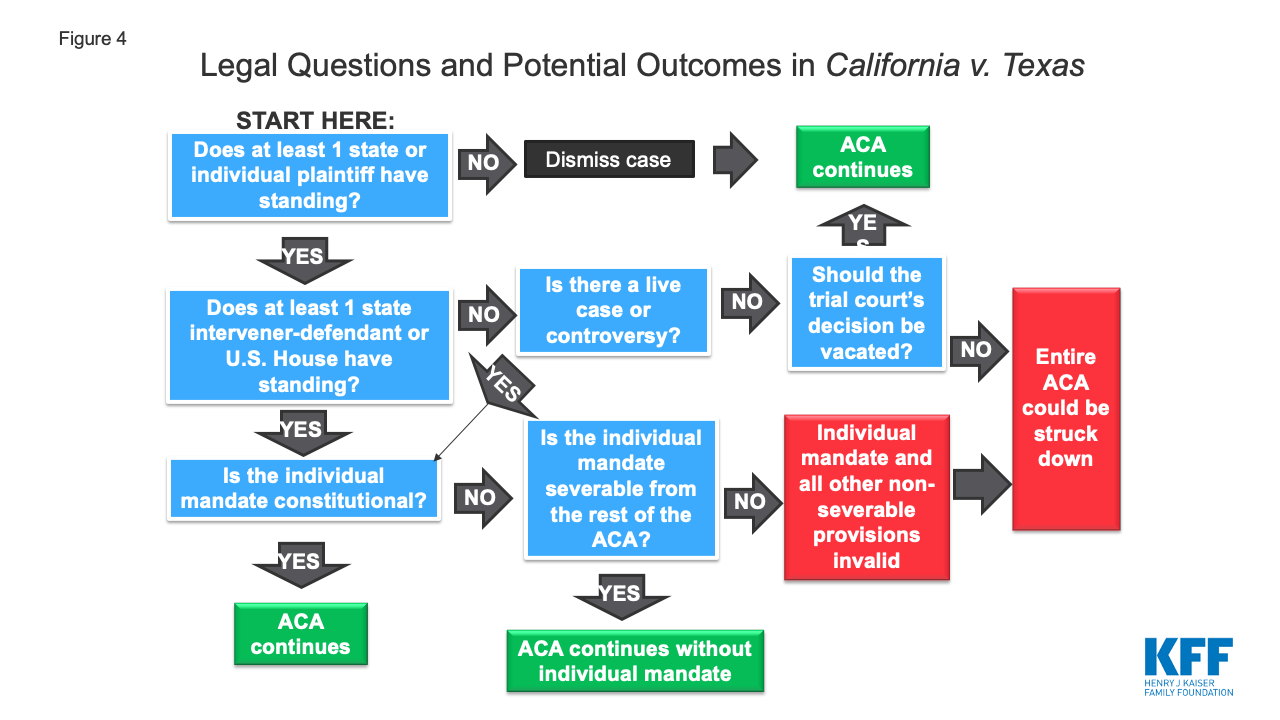

Potential Impact Of California V Texas Decision On Key Provisions Of The Affordable Care Act Kff

Follow Yes the Obamacare is still the law of the land however there is no more penalty for not having health insurance.

The insurance mandate of the aca is still in effect. The repeal of the mandate is not immediate. People should continue securing coverage options for 2018 and paying their premiums. Because the ACA has not been repealed and replaced it also means that the individual mandate is still in effect.

Is the Affordable Care Act still in effect 2020. Every person in the US. 1 When Did the Individual Mandate Repeal Take Effect1.

But unless you undergo a personal IRS tax audit the IRS would never have sufficient knowledge to assess the non-insurance payment tax. Status of the ACAs Individual Mandate. Obamacare is still active although one of its clauses is not.

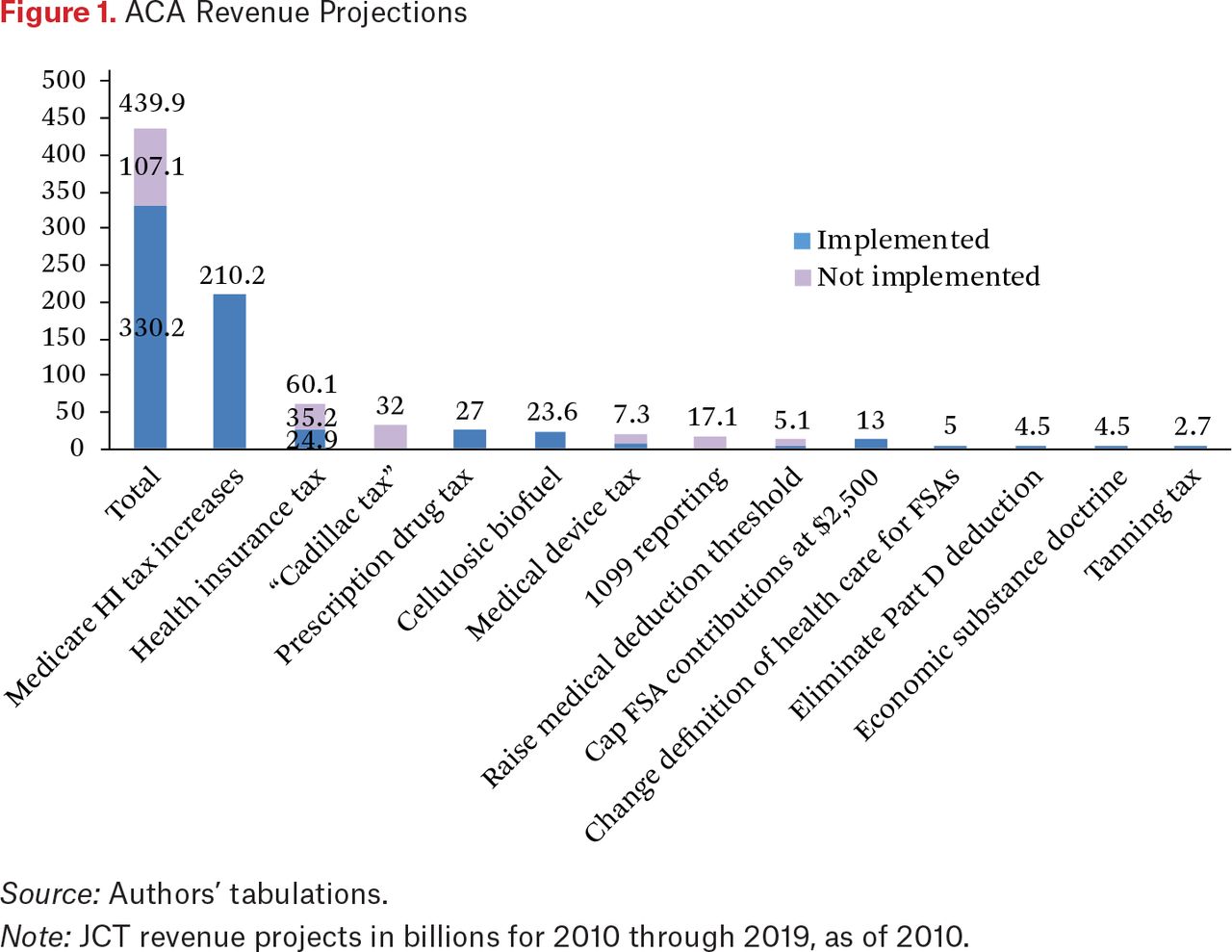

This means that at present there is no penalty for not buying the health insurance under Obamacare. These taxes were designed to help pay for the ACAs coverage expansion. The Affordable Care Acts individual mandate a provision that required all Americans to have health insurance or pay a tax penalty was repealed in December 2017.

But starting with the 2019 tax year there is no longer a penalty for non-compliance with the individual mandate. Texas will determine the. Once signed into law by President Donald Trump the repeal will go into effect in 2019.

The ACA provision stipulated that all Americans must have health insurance coverage or pay a penalty. However the ACA employer mandate will remain which means large employers will still need to offer coverage meeting minimum standards to avoid penalties Nevertheless Repeal of the ACA. Is required to have some sort of major medical insurance or face a tax penalty.

The individual mandate which took effect on January 1 2014 is a requirement of the ACA that most citizens and legal residents of the United States have health insurance. Each year Applicable Large Employers have to file or re-file the right documents to prove to the government that they are offering employees approved health insurance at the right time. Repeal of the health insurance tax would not take effect until 2021 meaning the taxwhich has already been built in to many premiums for the 2020 plan yearwill remain in effect for 2020.

The individual mandate which requires most Americans to maintain health coverage still exists. The individual mandate remains one of the ACAs most politically charged provisions. The Affordable Care Act ACA includes a mandate for every person to obtain health insurance to guard against adverse selection in the markets.

Effect of the Executive Order to minimize the ACAs impact on businesses and. At present Obamacare or the Affordable Healthcare Act is active although one of its main clauses the individual mandate has been abolished at the federal level since 2019. People who do not have health insurance must obtain it or pay a penalty.

While the individual mandate is no longer in effect you may still owe a fee depending on your state of residence. The Affordable Care Act ACAcolloquially called Obamacareis still in effect but an upcoming Supreme Court decision could take it down. The result is that the ACA is still in effect until the Senate andor House both Republican-led can craft a viable alternative that will garner sufficient votes.

The IRS has stated that taxpayers are still required to pay the individual mandate penalty if they forego insurance because these ACA laws are still in effect. In most states people who were uninsured in 2019 or 2020 were not assessed a penalty and that will continue to be the case for 2021. The ACAs individual mandate penalty which used to be collected by the IRS on federal tax returns was reduced to 0 after the end of 2018.

Politicians may be debating the law but as of now the ACA employer mandate is still in effect and ALEs are required to comply with the law for the coming year.

The Health Insurance Penalty Ends In 2019

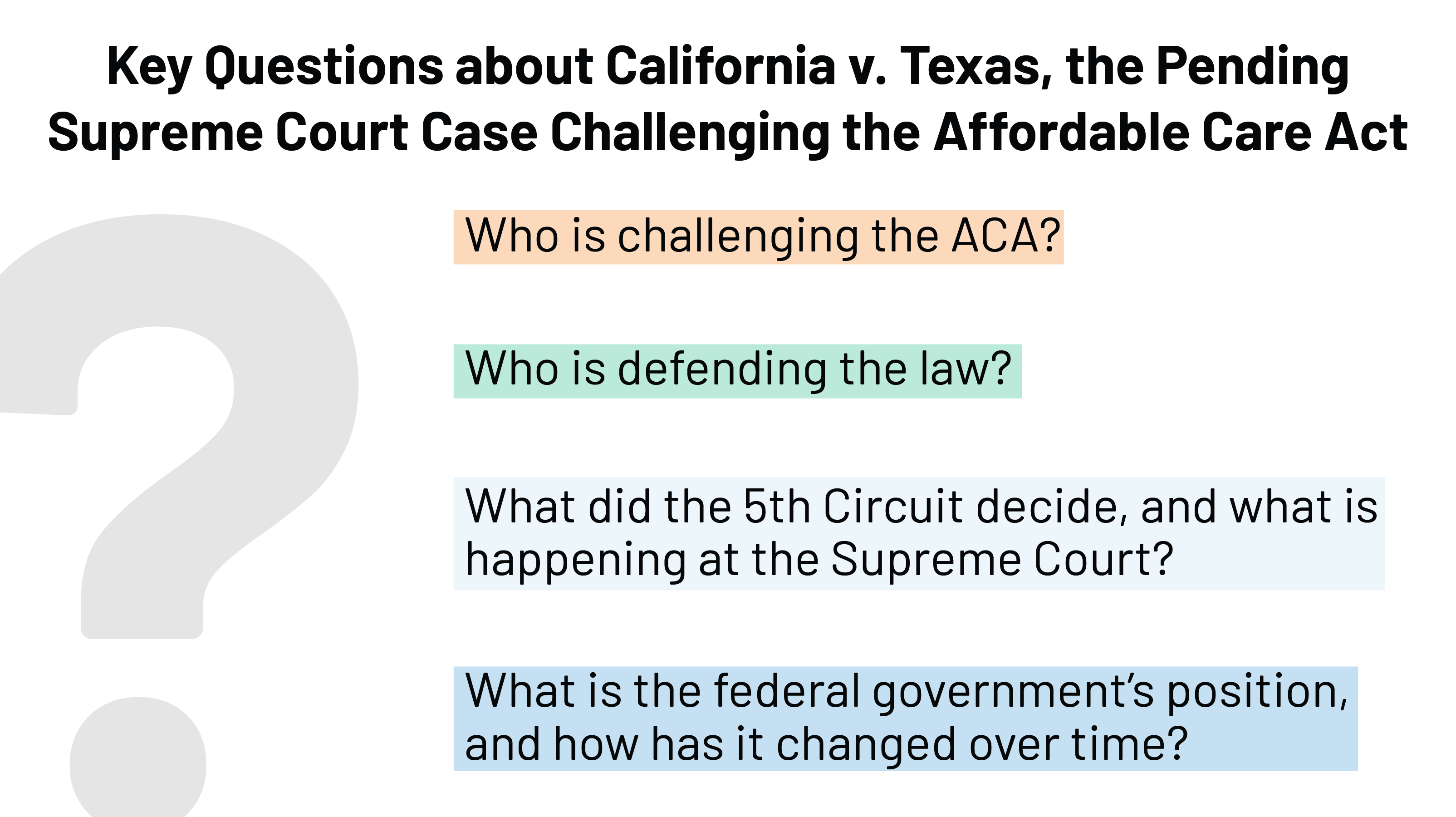

Explaining California V Texas A Guide To The Case Challenging The Aca Kff

Why An Individual Mandate Is Important And What States Can Do About It Lessons From Massachusetts The Health Care Blog

The 2020 Changes To California Health Insurance Ehealth

How Can I Avoid An Obamacare Tax Penalty In 2019 Ehealth Insurance

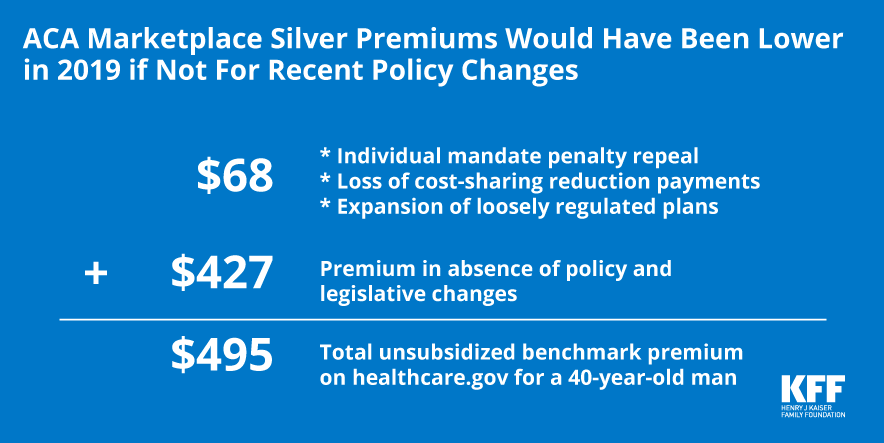

How Repeal Of The Individual Mandate And Expansion Of Loosely Regulated Plans Are Affecting 2019 Premiums Kff

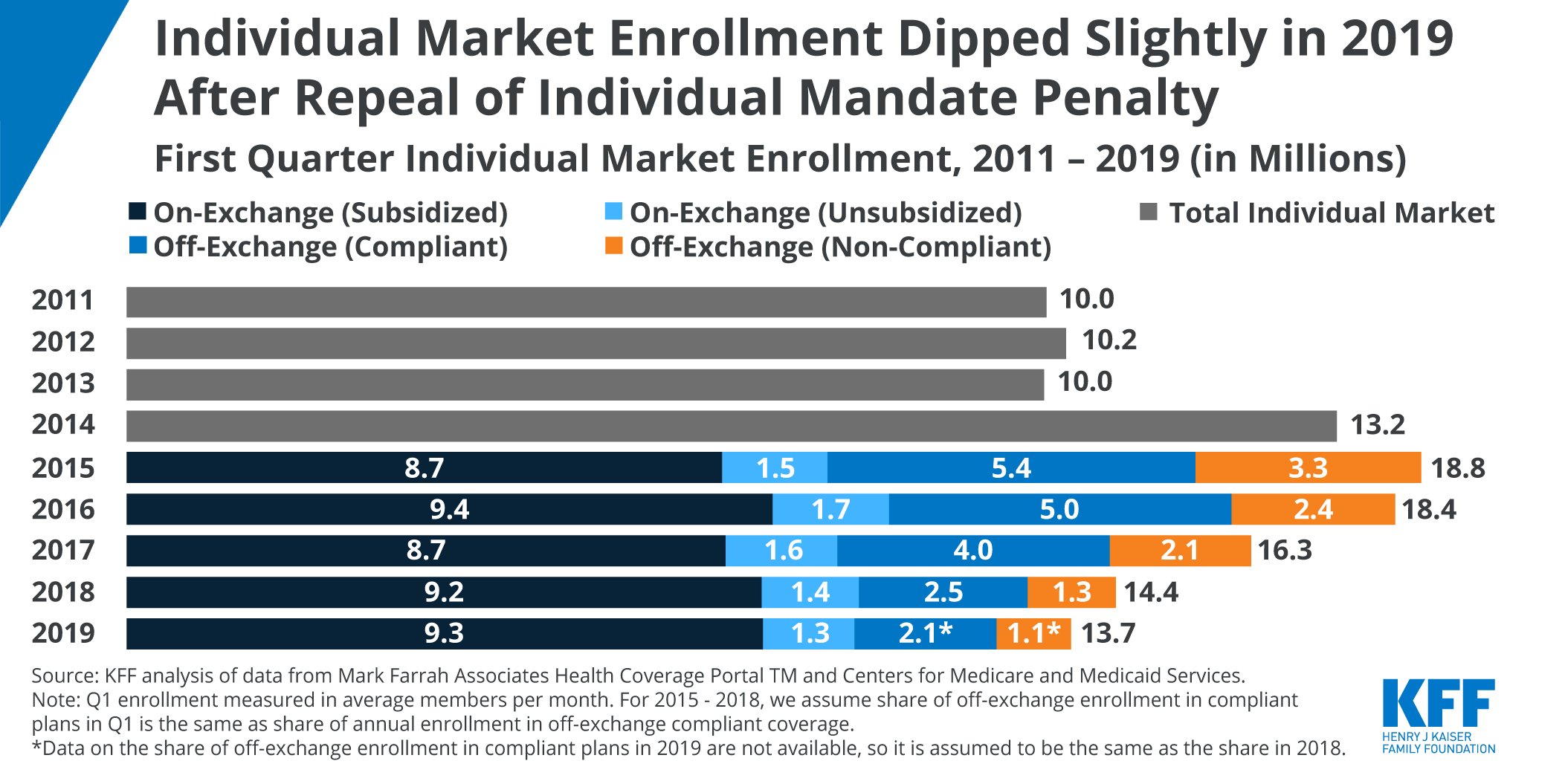

Data Note Changes In Enrollment In The Individual Health Insurance Market Through Early 2019 Kff

State Actions To Improve The Affordability Of Health Insurance In The Individual Market Kff

Affordable Care Act Faqs Ehealth Insurance

What S Left Of The Affordable Care Act A Progress Report Rsf The Russell Sage Foundation Journal Of The Social Sciences

Affordable Care Act Challenge Texas Et Al V United States Texas Federal District Court 2018 Subscript Law

Will You Owe A Penalty Under Obamacare Healthinsurance Org

Employer Vs Individual Different Mandates Different Implications Urban Institute

State Lawsuit Claims That Individual Mandate Penalty Repeal Should Topple Entire Aca Health Affairs

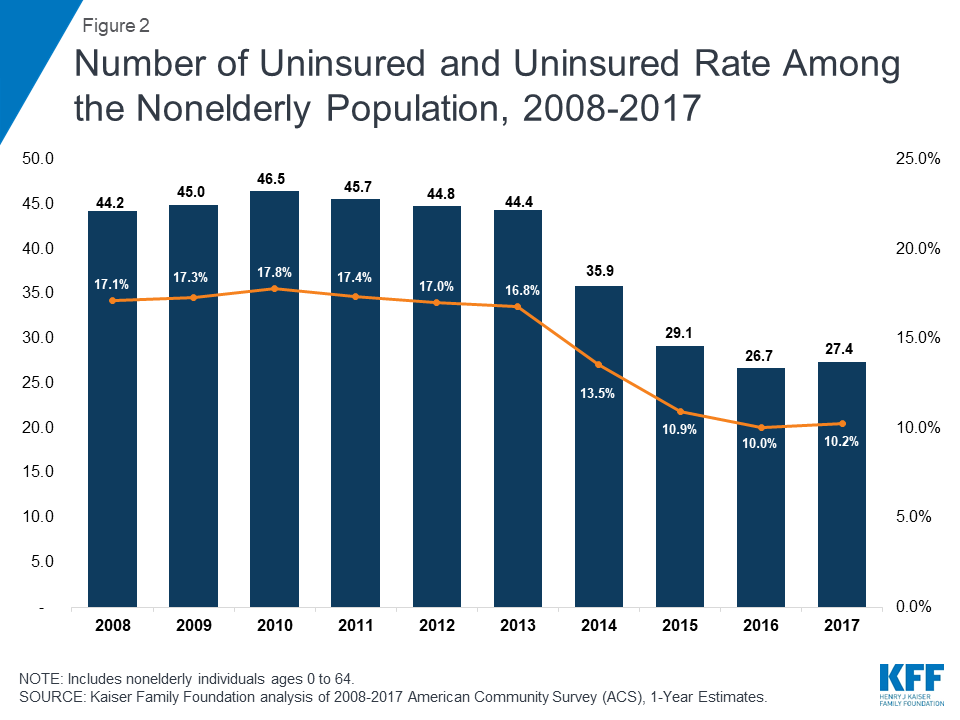

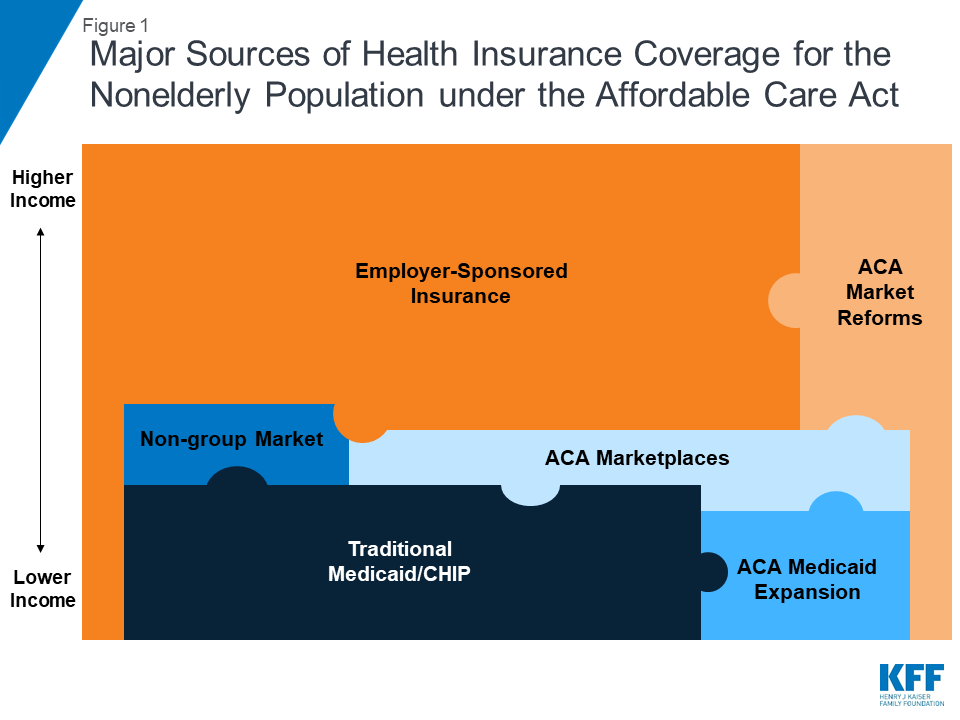

The Uninsured And The Aca A Primer Key Facts About Health Insurance And The Uninsured Amidst Changes To The Affordable Care Act How Have Health Insurance Coverage Options And Availability

The Uninsured And The Aca A Primer Key Facts About Health Insurance And The Uninsured Amidst Changes To The Affordable Care Act How Have Health Insurance Coverage Options And Availability

Open Enrollment 2022 Guide Healthinsurance Org

New Jersey State Individual Mandate Tango Health Tango Health

Explaining California V Texas A Guide To The Case Challenging The Aca Kff

Post a Comment for "The Insurance Mandate Of The Aca Is Still In Effect"