Sr 22 Insurance Texas Cost

Here it is spelled out. Overall drivers see a 70 to 90 increase from their standard insurance price.

Sr22 Texas Insurance The Cheapest Only 7 Month

Most insurance companies will charge a filing fee of 15 to 40 to add the SR22 filing to an auto insurance policy.

Sr 22 insurance texas cost. 3 rows Generally the SR-22 filing fee is around 25 though your car insurance rates will. To get your drivers license reinstated you first need to pay a reinstatement fee which is typically around 100 before submitting an SR-22 form to the Texas DPS in Austin. A Financial Responsibility Insurance Certificate SR-22 is required by the Texas Transportation Code Chapter 601 to verify that you are maintaining motor vehicle liability insurance.

The minimal amount of insurance coverage you need with SR22 Texas insurance is exactly the same as that of normal vehicle insurance coverage. If you fail to maintain financial responsibility you. Filing an SR-22 in Texas is relatively inexpensive with fees maxing out at 50.

Get the best Fort Worth SR22 Insurance Quotation so that you can be legal to drive in your state. In some states youll have to pay the filing fee up front. Here we take a closer look at what SR22 insurance is how much it may cost you getting an SR22 and how long you may need it.

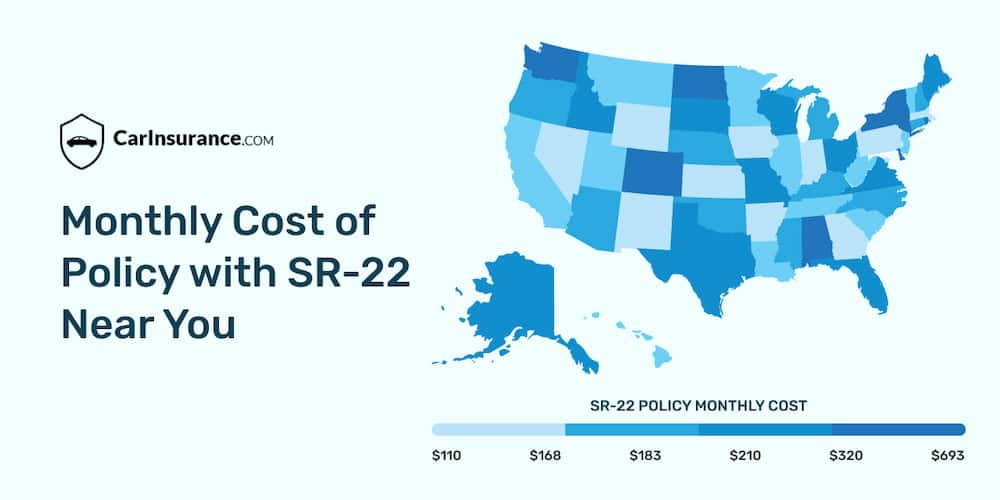

The cost of the SR22 insurance coverage itself depends mostly upon the limits of liability preferred whether physical damage for the lorry is needed and the surcharge for the infractions incurred. SR 22 insurance can vary in cost depending on the state you live in and also on the insurance company offering coverage. SR-22 insurance is not necessarily high risk insurance.

Youll also need to pay the filing fee with each policy term that the SR-22 is required. At Progressive well include the fee for the SR-22 filing in your cost for each policy term. However the violation that resulted in an SR22 requirement will affect your auto insurance premium.

The type of policy can be liability only full coverage or a non-owner policy. Under SR-22 requirements in Texas you typically have to obtain and carry an SR-22 for two years. However this figure can be lower or higher depending on the persons unique risk factors.

All that you can be sure of is there will be an increase from your former rategenerally SR-22 plans in Texas range between 824 to 3100 per year. How Much Does SR22 Insurance Cost in Texas. SR22 Insurance Cost An SR22 insurance is the same as an ordinary car insurance policy with a few changes to take into account the motorists violations that are often covered in the SR22 Insurance cost.

SR22 Insurance Cost the CHEAPEST SR22. SR-22 Insurance Quotes Fort Worth Texas. How much does it cost.

A SR-22 can be issued by most insurance providers and certifies that you have the minimum liability insurance as required by law. SR22 Insurance near me in Fort Worth. An insurance provider will automatically notify the Department when a SR-22 is cancelled terminated.

In Texas this is 30000 for every person whos hurt in an automobile accident that is your own fault with a maximum. Your insurer may charge a flat fee between 15 and 50 to file the form on your behalf. Cost of SR-22 insurance in Texas SR-22 is a certificate which typically costs around 15-25 but is only necessary because a severe infraction on.

A fee is charged by the insurance company to submit an SR-22 since of the additional paperwork involved. An SR-22 costs approximately 25 to file though the cost may vary by state and the insurance company. Remember an SR-22 is a result of a significant traffic violation something insurers dont take lightly.

Pay the appropriate SR-22 fee. In short its your infraction -- not the SR22 -- that will hike up your rates. SR22 insurance companies can charge a one-time filing fee generally it is 25 and that is the standard SR22 insurance cost.

SR22 Insurance Texas In Texas the average SR22 auto policy is around 2700 which is 64 higher than other drivers in the state. SR22 Insurance cost Fort Worth TX. Only 12month FREE quotes.

But insurance with an SR-22 requirement is significantly more expensive. You will have to carry an SR22 certificate on your auto policy for a minimum of two years. An SR-22 insurance policy is a certificate of insurance that shows the Texas Department of Public Safety DPS proof of insurance for the future as required by law.

Although filing this form costs less than 50 in Texas needing an SR-22 means youll be paying higher car insurance premiums until youve proven you can drive without a. 30000 for bodily injury to or death of one person in one accident 60000 for bodily injury to or death of two or more persons in one accident 25000 for damage to or destruction of property of others in one accident.

Washington State Car Insurance Compare Quotes Insurance Quotes

Sr22 Insurance Guide What Is Sr22 Insurance How Much Does It Cost

Allstate Auto Quote Car Insurance Quotes Allstate

Sr 22 Insurance In Texas What Is It How Much Does It Cost Valuepenguin

Automotive Business Insurance Quote Term Life Insurance Quotes Life Insurance Quotes Home Insurance Quotes

Dsd Insurance Unique Allstate Auto Card Luxury Texas Document Insurance Quotes Motorcycle Insurance Quote Quotes

What You Know About State Farm Car Insurance And What You Dont Know About State Farm Car Insurance Home Insurance Quotes Life Insurance Quotes Insurance Quotes

Sr22 Insurance Guide What Is Sr22 Insurance How Much Does It Cost

68 Reference Of Auto Insurance Yuba City Ca Car Insurance Cheapest Insurance Insurance

Dsd Insurance Unique Allstate Auto Card Luxury Texas Document Insurance Quotes Motorcycle Insurance Quote Quotes

Sr22 Insurance Guide What Is Sr22 Insurance How Much Does It Cost

Sr22 Insurance Guide What Is Sr22 Insurance How Much Does It Cost

Auto Insurance Comparisons Org Review Di 2021

Is Progressive Auto Insurance Any Good Di 2021

Sr 22 Insurance In Oregon What Is It How Much Does It Cost Valuepenguin

Sr 22 Insurance In Indiana What Is It How Much Does It Cost Valuepenguin

Post a Comment for "Sr 22 Insurance Texas Cost"