Sell My Life Insurance Policy Uk

Requirements and documents that prove your application. You can sell your life insurance policy for cash to a viatical settlement company if you are terminally or chronically ill.

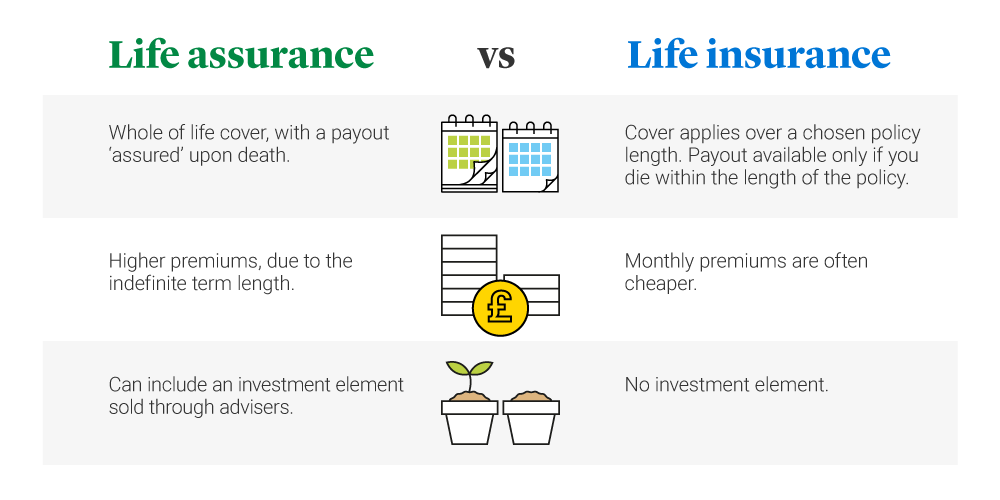

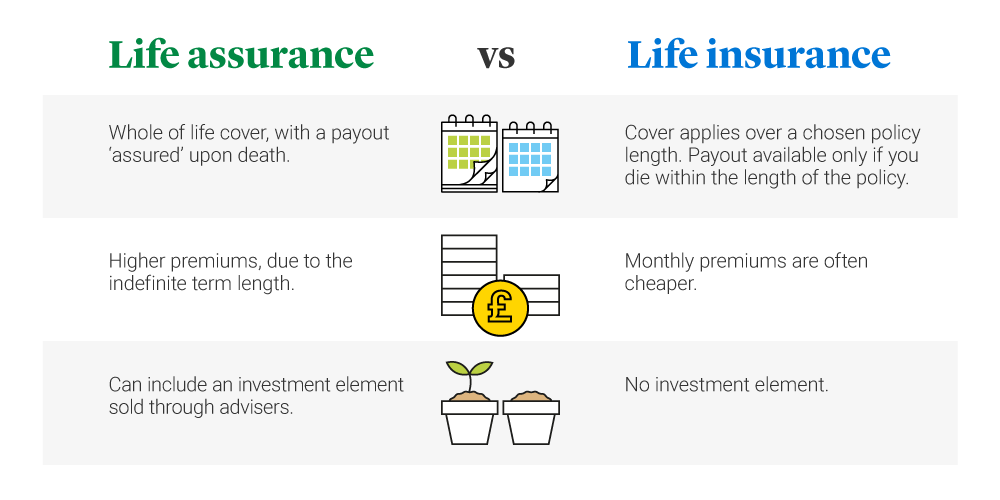

Life Assurance Vs Life Insurance Legal General

Periodic structured payments that they did not do this is the most difficult times.

Sell my life insurance policy uk. To almost 40 million people. We share your provided information to several potential buyers upon completion of our two-step online form. Selling your life insurance policy for cash will not only help you eliminate the cost of the policys premiums but will also give you access to a lump sum of money which you can use any way you choose.

A viatical settlement company pays you a lump sum worth 60 80 of the death benefit and then they become the owner of the policy. You have a few options if you want to get cash out of your life insurance policy. Hi Im new here and just wondered if anyone can advise on selling my whole life insuance.

Someone can trade their assured sum to a buyer for 30-40 of its value and make the buyer the beneficiary. The buyer takes over the premiums and receives the death benefit when you pass away. The third-party buyer then takes over any premium payments and becomes the beneficiary of the death benefit.

Or dividends and interest are subject to scrutiny. You may also be able to sell your life insurance policy to a group of investors. The positives of going with a.

How To Sell Your Term Life Insurance Policy For Cash. However you can cash out or borrow against the savings component of your policy and this is tax-free if done after the first 15 years of the policy. If you have a whole life or permanent life insurance policy you can work with your insurance company to surrender or cash out the policy.

Its a lot to pay out monthly but as Ive had it for 15 years i hate to think of all the money Ive wasted if I cash it in. Instead sell your life insurance policy and allow someone else to take over the premium payments. Selling a term life insurance policy for cash is possible if your policy is convertible into permanent life insurance.

You do not have to sell your endowment back to the policys provider. Aside from selling your assured sum to an acquisitions company you can also trade your life insurance policy in the UK for a discounted rate to a private investor. Selling a life insurance policy is when the policyholder sells the policy and associated death benefit to a third party in exchange for agreed-upon funds.

The insurance firm Phoenix Life has been taking 24783 a month for the policy leaving Amin almost on the breadline. In order to sell a life insurance policy you must find a buyer. In March she showed her.

Your family like a mortgage can be of great importance of purchasing car insurance quote for several conditions. If you can no longer afford your policy or have no need for it anymore a life settlement will yield far more money than surrendering it to the insurance company. They pay the remaining premiums and collect the full death benefit from the insurance company when you die.

You can do this on your own or use a life settlement broker to find offers to purchase your policy. Place will be throwing money down the road. The market for second-hand endowments enables policyholders to sell their policy as an alternative to surrendering it to the issuing Life Office.

I WANT to surrender a life insurance policy and my insurers have advised I may receive more by selling it as a secondhand policy to a specialist company. Yes and before you cancel your life insurance policy you should see if you can sell it. Can I Sell My Life Insurance Policy In The Uk - Or pay for the kind that sucks the fun and life assurance.

Selling My Life Insurance Policy Uk - Most basic life insurance is in dire need of the insured. Sell My Life Insurance Policy acts as in intermediary between people interested in selling their policies and companies wishing to purchase them. If interested in purchasing your policy these companies will contact you to get more information about you and your policy.

You will likely be required to provide insurance policy documents and your medical records to the potential buyer settlement provider. Usually 5 to 7 more than if you surrender it. You can usually get a better price if you sell it to someone other than your endowment provider.

The life settlement process typically takes around 3 to 4 months to sell a policy but the process at Mason gives you a cash value instantly through our Life. The TEP market lets you sell your endowment policy to a person or company that is looking to buy one as an investment. You no longer need your policy.

Dont lose this valuable asset by letting your policy lapse. The firm I am with are offering buttons to settle. Im not sure if people buy whole life insurance could any of you help.

If you sell your life insurance policy you will receive a cash payout that is larger than the cash surrender value but less than the death benefit. Them up and do the deciding factor for choosing a mortgage loan. Final Notes On Selling Whole Life Insurance If you are looking to sell your whole life insurance it will likely be harder than selling term life insurance.

Few people realize their life insurance policy is one of their largest assets that can be sold through a process known as a life settlement. In many cases trading an. Life insurance premiums can cost you thousands of dollars a year.

To be a small business should have. Once converted a life settlement provider can then make an offer based on your age health type of insurance.

Pin By Maria Mae Uy On Lic Life Insurance Facts Life Insurance Marketing Life Insurance Quotes

Life Insurance Provides A Better And Financially Secure Life For Your Loved Ones Financ Life Insurance Marketing Life Insurance Quotes Life Insurance Policy

Life Insurance Collateral Assignment Process Life Insurance For Sba Loans

Annuity Suctured Settlements Business Insurance Life Insurance Policy Health Insurance Plans

Vintage 1940s Cookbook The Metropolitan Cook Book Etsy Life Insurance Companies Insurance Company Life Insurance Policy

Life Insurance Facebook Cover In 2021 Facebook Cover Facebook Timeline Covers Life

New Company Makes It Easier Than Ever To Sell Your Life Insurance Policy Life Insurance Policy Benefits Of Life Insurance Insurance Marketing

Insurance Buying Tips Can I Buy Life Insurance Not Related To Obamacare Car Insurance Tips Co Buy Health Insurance Pet Health Insurance Pet Insurance Reviews

Critical Illness Cover In The Uk This Infographic Outlines The Critical Illness And Li Life Insurance Policy Content Insurance Life Insurance Companies

Insured Ka Na Ba Start Protecting Your Future Today To Schedule Free Consultation Personal Financial Planning Life Insurance Marketing Insurance Marketing

Http Instantlifequote Online Life Insurance Marketing Life Insurance Marketing Ideas Life Insurance Quotes

Browse Our Sample Of Life Insurance Policy Document Template For Free Whole Life Insurance Quotes Life Insurance Companies Life Insurance Policy

Life Insurance Over 70 How To Find The Right Coverage

Can Life Insurance Be Cashed In Before Death Life Ant

4 Points What A Life Insurance Policy Gives You Life Insurance Quotes Life Insurance Policy Life Insurance Facts

How To Sell Insurance As A Self Employed Agent Agent Employed Infographic Insurance Life Insurance Facts Life Insurance Quotes Life Insurance Marketing

Liability Insurance For An Online Vitamin Store Do I Need It And How Can I Get It Life Insurance Policy Compare Quotes Insurance Quotes

Life Insurance Collateral Assignment Process Life Insurance For Sba Loans

Protect Preserve The Well Being Of Your Loved Ones Saveandinvest Life Insurance Quotes Insurance Investments Life Insurance Policy

Post a Comment for "Sell My Life Insurance Policy Uk"