Domestic Trade Credit Insurance India

91 11 4053 8223 F. Domestic trade credit insurance provides companies with the protection they need as their customer base consolidates creating larger receivables to fewer customers.

Insure My Sales With Trade Credit Insurance

Targeted at banks as insureds and direct service recipients the product covers the risk of the domestic buyer importer failing to reimburse the bank due to bankruptcy default on payment or other commercial risks.

Domestic trade credit insurance india. 317 Maximum Extension Period The maximum additional period of credit that the insured may grant to any. Domestic Trade Credit Insurance Import Factoring This product is designed principally for the import factoring business of banks. FCIA offers export and domestic trade credit insurance as well as a wide variety of specialty trade credit and political risk products that facilitate global trade and related financing activities.

The trade credit insurance policy would cover the risk of non payment due to insolvency or protracted default only and political risks can be covered only in case of buyers outside india. D ue to its marked financial attributes short-term domestic trade credit insurance has played an active protective role in domestic trade particularly commodities trading in recent years. Informieren und online abschliessen.

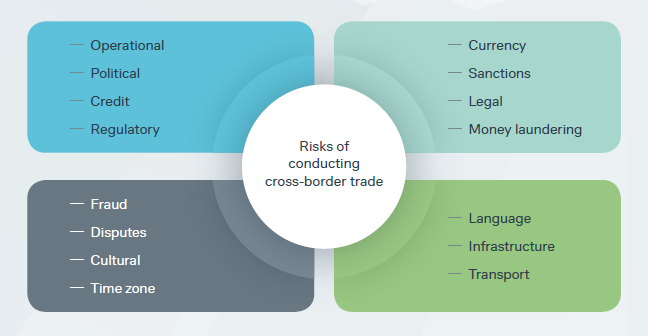

If you are also exporting to overseas your other concerns which trade credit insurance can address are public buyer risk payment transfer risk import restrictions risk. Between small companies with an annual turnover of less than USD 5 million and larger companies with a turnover above this threshold. For domestic sales trade credit insurance would cover for risk involving insolvency of clients and default of payment.

Trade credit insurance has been especially formulated to protect the policyholders business against risks which are beyond their control. The terms of the sale mention the period for which credit is granted along with any cash discount and the type of credit instrument being used. Domestic Credit Insurance covers to Exporters and Banks in respect of their local sales and working capital finance respectively Overseas Investment Insurance covers to protect Indian Entrepreneurs investing in Overseas Ventures EquityLoans against expropriation risks.

Our Credit Insurance Globalliance Policy is designed for companies that are selling their goods andor services on credit to overseas buyers. Anzeige Zinsen ab 45 fr Eigenheimbesitzer. Turnover below EUR 5 Million Buyer.

This further creates a larger exposure and greater risk if a customer does not pay their accounts. This policy provides coverage to companies for outstanding receivables that are within approved credit terms thereby protecting the Insured against non-payment risk by its buyers. 91 80 4112 1800 F.

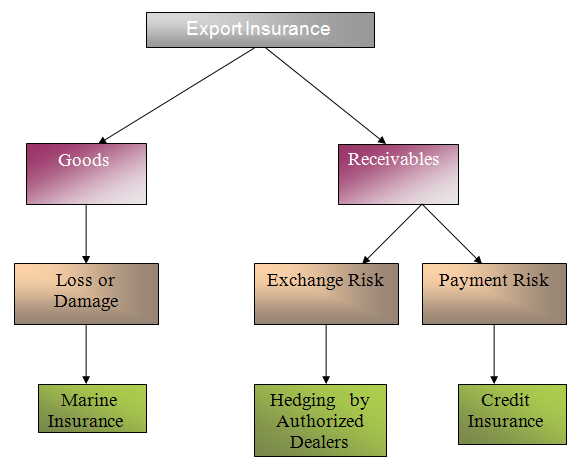

316 Maximum Credit Period The original due date from the date of invoice plus maximum extension period and shall not exceed 180 days in case of domestic sales and 365 days in case of export sales. Between export and domestic trade credit insurance. Trade Credit Insurance Policy offers coverage to the supplier of goods and services against any delay in payment or non-payment of trade credit due to the commercial or political risks.

Trade credit insurance protects you against the risk of your customers not paying you when trading within India or overseas. Between single-risk and annual policies. Policies insure any combination of domestic and international sales of goods and services.

14 District Centre Jasola New Delhi 110025 India T. A comprehensive trade credit insurance policy ensures improvement of bottom line quality increase profits and reduce risks of unforeseen customer insolvency. You can also offer credit to new customers.

Under the discretionary credit limit. Informieren und online abschliessen. However due to the slowdown in the Chinese economy credit insurance has become one of the types of insurance with a relatively high risk probability in the past two years.

In addition to documenting the development of the market value from 2009 to 2013 the report also divides it for the most recent year between four key segments. 4 2021 PRNewswire -- The Credit Insurance Market is Segmented by Type Domestic Trade Export Trade by Application Buyer. For example if your business supplies goods or services to other companies on credit terms trade credit insurance can protect against your customers failing to pay you.

3 Kasturaba Road Bangalore 560001 India T. What is trade credit insurance and how does it work. Trade credit insurance india.

BANGALORE India Jan. This Trade Credit Insurance policy can be purchased or renewed online Policy is available for domestic supplier and exporter This policy is ideal for those companies who sell their goods on open account basis. Anzeige Zinsen ab 45 fr Eigenheimbesitzer.

Berne Union Member List Contacts

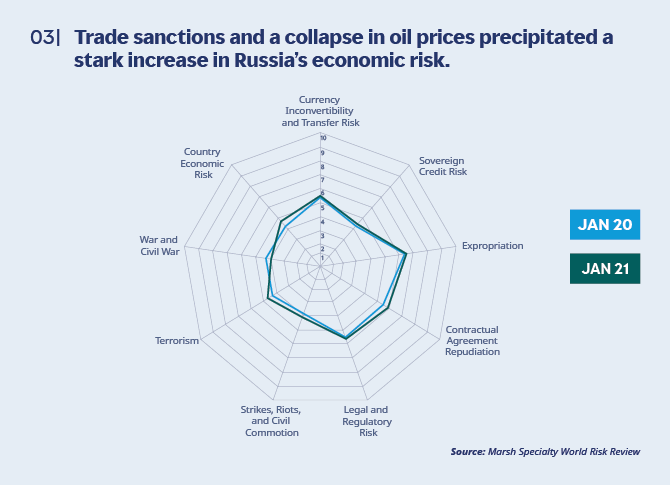

Political Risk Map 2021 Pandemic Recovery Complicates Risks For Europe

Political Risk Map 2021 Pandemic Recovery Complicates Risks For Europe

Insure My Sales With Trade Credit Insurance

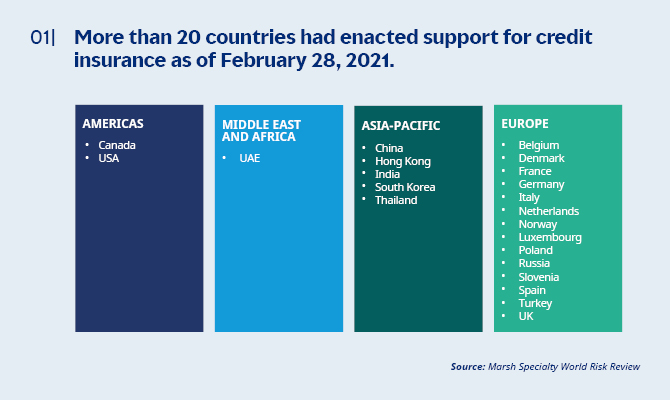

Trade Finance In Times Of Crisis Responses From Export Credit Agencies

Https Www Jstor Org Stable 24548129

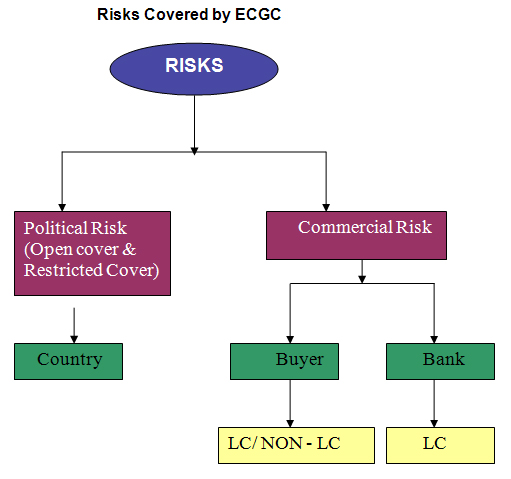

Role Of Ecgc In Credit Insurance

Insure My Sales With Trade Credit Insurance

Role Of Ecgc In Credit Insurance

What Is Trade Credit Insurance Coface

Atradius India Trade Credit Insurance

Coface Credit Insurance Trade Credit Solutions Our Offer Coface

Trade Finance In Times Of Crisis Responses From Export Credit Agencies

Post a Comment for "Domestic Trade Credit Insurance India"